U.S. Stocks Fall on Budget, Economic Growth Concerns

By Lu Wang - Sep 25, 2013 5:01 AM GMT+0800

U.S. stocks fell for a fourth day amid concerns over budget talks and economic growth as investors weighed prospects for easing tensions in the Middle East.

Red Hat Inc. slumped 12 percent after billings at the largest seller of the Linux operating system trailed estimates. Homebuilders gained 2.3 percent as a group after a report showed home prices increased by the most in more than seven years and Lennar Corp.?s profit beat analyst estimates. Applied Materials Inc. advanced 9.1 percent after agreeing to buy Tokyo Electron Ltd. for about $9.39 billion in stock.

The Standard & Poor?s 500 Index fell 0.3 percent to 1,697.42 at 4 p.m. in New York. The Dow Jones Industrial Average lost 66.79 points, or 0.4 percent, to 15,334.59. About 6 billion shares changed hands on U.S. exchanges, in line with the three-month average.

The market is ?riding waves of news, both good and bad,? Malcolm Polley, the chief investment officer at Stewart Capital Advisors LLC in Indiana, Pennsylvania, said in a telephone interview. His firm manages $1.1 billion. ?The market is very dependent on macro news.?

The S& P 500 initially fell as much as 0.4 percent after the Conference Board?s index of U.S. consumer confidence slumped in September to a four-month low. A separate report showed a gauge of manufacturing in the region covered by the Federal Reserve Bank of Richmond shrank in September.

?Meaningful Agreement?

The equity benchmark index erased earlier losses as President Barack Obama said recent overtures from Iran may offer a basis for a ?meaningful agreement? to resolve the confrontation over the Persian Gulf nation?s nuclear program, one of the primary sources of instability in the Middle East. Iranian officials told the U.S. that the time isn?t right for direct contact between the two countries? leaders.

Stocks turned lower in the last 30 minutes of trading as investors watched the debate in Washington over spending cuts. U.S. Senate Democrats offered a new proposal that funds the government through Nov. 15, complicating efforts to avoid a government shutdown in a week as Republican Senator Ted Cruz began an extended speech in opposition to funding for the health-care law.

?We may have a couple few weeks where there is still lingering concern over the Fed along with very much headline risk around the budget ceiling debate,? David Chalupnik, head of equities at Nuveen Asset Management in Minneapolis, said in a phone interview. His firm manages more than $115 billion. ?Over the short term, we would see the market continue to either muddle through or consolidate before we hit earnings season.?

Stimulus Debate

The S& P 500 has declined 1.6 percent over four days after reaching an all-time high of 1,725.52 as the Federal Reserve refrained from cutting stimulus. The Federal Open Market Committee said after its Sept. 17-18 meeting that it wants more evidence of an economic recovery before paring its $85 billion of monthly asset purchases, surprising economists who had forecast a reduction. The S& P 500 has gained 5.7 percent this quarter and is up about 19 percent for the year.

Fed Bank of New York President William C. Dudley said today the central bank may reduce the pace of its quantitative easing program in 2013 depending on the economy?s performance.

?If the economy were behaving in a way aligned with the Fed?s June forecast, then it?s certainly likely that the Fed would begin to taper later this year,? Dudley said in an interview with CNBC. ?I certainly wouldn?t want to rule it out. But it depends on the data.?

?Different Views?

Stocks fell on Sept. 20 as Fed Bank of St. Louis President James Bullard said policy makers may decide to reduce their monthly bond purchases at the meeting in October.

?There are so many different views from the Fed itself and there is no one voice that seems to be articulating a common message,? Mark Freeman, who oversees about $15.8 billion as chief investment officer at Westwood Holdings Group Inc. in Dallas, said by phone. ?What they ultimately created is uncertainty and that?s never a positive for the market.?

The Chicago Board Options Exchange Volatility Index, the gauge of S& P 500 options prices known as the VIX, slipped 1.6 percent to 14.08, extending its drop for the year to 22 percent.

Seven out of 10 S& P 500 groups fell as telephone and consumer-staples companies declined more than 0.7 percent for the worst performance.

Red Hat tumbled 12 percent, the most in the S& P 500, to $46.73. Billings, a predictor of future revenue, rose 8 percent in the second quarter from a year earlier to $376 million. Analysts at CLSA had projected an increase of 17 percent, and Stifel Nicolaus & Co. predicted 14 percent growth.

World Markets

North and South American markets finished lower today with shares in Brazil leading the region. The Bovespa is down 0.31% while U.S.'s S& P 500 is off 0.26% and Mexico's IPC is lower by 0.25%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | -66.79 | -0.43% | 15,334.59 | 4:42pm ET |

|

S& P 500 Index | United States | -4.42 | -0.26% | 1,697.42 | 4:42pm ET |

|

Brazil Bovespa Stock Index | Brazil | -171.33 | -0.31% | 54,431.05 | 6:01pm ET |

|

Canada S& P/TSX 60 | Canada | +1.07 | +0.15% | 736.30 | 4:20pm ET |

|

Santiago Index IPSA | Chile | -28.66 | -0.85% | 3,327.35 | 3:25pm ET |

|

IPC | Mexico | -104.73 | -0.25% | 41,209.95 | 4:06pm ET |

|

Then He said to them, ?Nation will rise against nation, and kingdom against kingdom. And there will be great earthquakes in various places, and famines and pestilences and there will be fearful sights and great signs from heaven. (Luke 21:10, 11)

Magnitude: 7.8

Location: 69km NNE of Awaran, Pakistan

Time:Tue, 24 Sep 2013 11:29:48 GMT

7.8 earthquake strikes Pakistan, shaking felt in New Delhi

Published time: September 24, 2013 11:49Edited time: September 24, 2013 12:27

Down future -4 oni...

..... I think I have to start make ..

Green Huat Kueh tonight....

Cheers!!!

Short sell orders executed on 24 September 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20130924.txt

Remember to short....

Coal activist to stand trial over fake ANZ statement

A man has been committed to stand trial over a hoax ANZ media release that temporarily slashed $300m off the value of Whitehaven Coal. Anti-coal activist Jonathan Moylan is charged with making a false and misleading statement under the Corporations Act. The fake statement released in January claimed the bank had withdrawn from a NSW mining project on environmental grounds.

Small cap shares top trading in steady Singapore market

Small and mid-cap companies such as Albedo Ltdand YHM

Group Ltddominated the list of most actively traded

stocks in Singapore on Tuesday, with the broader index little

changed.

YHM Group, controlled by Singapore-based offshore oilfield

service firm Ezion Holdings Ltd, rose 12 percent to

S$0.064, up for the fourth day in a row. On Monday, the company

said it had won a contract worth about $183 million to provide a

semi-submersible rig.

The main Straits Times Index < .FTSTI> eased 0.1 percent to

3,210.1 in thin volume, with 70.4 million shares traded, about a

quarter of its 30-day average full-day volume. The index is

trading just below a seven-week high hit last week.

Asian stocks markets were mostly under water and currencies

dithered in recent ranges. [ID:nL4N0HJ3N3]

Shares in Sembcorp Marine Ltddipped 1.1 percent.

Brokerage CIMB issued an upbeat report on the company after a

tour of its integrated yard in Singapore.

" Given the keen competition from China and Korea, we think

that Sembcorp Marine will sharpen its rig-building capabilities

by consolidating its repair, conversion and offshore work at

this new yard and better utilise its existing yards for

rig-building," CIMB said in the report.

Small and mid-cap companies such as Albedo Ltd

Group Ltd

stocks in Singapore on Tuesday, with the broader index little

changed.

YHM Group, controlled by Singapore-based offshore oilfield

service firm Ezion Holdings Ltd

S$0.064, up for the fourth day in a row. On Monday, the company

said it had won a contract worth about $183 million to provide a

semi-submersible rig.

The main Straits Times Index < .FTSTI> eased 0.1 percent to

3,210.1 in thin volume, with 70.4 million shares traded, about a

quarter of its 30-day average full-day volume. The index is

trading just below a seven-week high hit last week.

Asian stocks markets were mostly under water and currencies

dithered in recent ranges. [ID:nL4N0HJ3N3]

Shares in Sembcorp Marine Ltd

Brokerage CIMB issued an upbeat report on the company after a

tour of its integrated yard in Singapore.

" Given the keen competition from China and Korea, we think

that Sembcorp Marine will sharpen its rig-building capabilities

by consolidating its repair, conversion and offshore work at

this new yard and better utilise its existing yards for

rig-building," CIMB said in the report.

Short sell orders executed on 23 September 2013

http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20130923.txt

Both NY Fed President William Dudley and Atlanta Fed chief Dennis Lockhart advocated that an accommodative monetary policy is still needed, while Dallas Fed President Richard Fisher warned the central bank has harmed its credibility with the decision last week not to taper its stimulus. The mixed messages have created more uncertainty about the future direction of US monetary policy and increased volatility in financial markets. Also damping sentiment is the upcoming debate over the US federal budget and debt ceiling, which may potentially lead to a government shutdown by 1 Oct or a debt default.

Measles warning for Sydneysiders

People in Sydney's inner and inner-western suburbs are being urged to look out for symptoms of measles and check they are vaccinated against the disease. 17 minutes ago

24 September 2013

IG Morning Brief

STI (60 MIN)

One scenario: as long as 3261 is a resistance, a decline towards 3202 and even 3175 seems likely.

Alternative scenario: a break above 3261 would invalidate our bearish scenario. The index could then rise to 3277.

SINGAPORE

The Straits Times index declined 0.72% or 23.36pts to 3214.17 (day range: 3220.73 - 3203.08) on Monday. The index is above its 20d MA (@ 3093) and above its 50d MA (@ 3168). 93% of the index constituents are above their 20D MA (vs unchanged the previous session) and 80% of the shares are above their 50D MA (vs 90%).

Singapore's CPI rose 2.0% YoY in August (as expected, vs +1.9% in July) according to the government.

Industrial Goods & Services: Noble Group (NOBL: -2.11% to S$0.93) closed at a 3-month relative low against the Straits Times Index.

Travel & Leisure: City Developments (CIT: -1.15% to S$10.35) closed at a 3-month relative low against the Straits Times Index.

Stock/Benchmark ratio(s) 50D MA cross over: Wilmar International (WIL: +0.94% to S$3.21)

Stock/Benchmark ratio(s) 50D MA cross under: Jardine Cycle & Carriage (JCNC: -4.12% to S$37.49), Jardine Matheson (JM: -3.62% to $55.9).

Stock(s) 50D MA cross under: City Developments (CIT: -1.15% to S$10.35), Jardine Cycle & Carriage (JCNC: -4.12% to S$37.49).

IG Morning Brief

STI (60 MIN)

One scenario: as long as 3261 is a resistance, a decline towards 3202 and even 3175 seems likely.

Alternative scenario: a break above 3261 would invalidate our bearish scenario. The index could then rise to 3277.

SINGAPORE

The Straits Times index declined 0.72% or 23.36pts to 3214.17 (day range: 3220.73 - 3203.08) on Monday. The index is above its 20d MA (@ 3093) and above its 50d MA (@ 3168). 93% of the index constituents are above their 20D MA (vs unchanged the previous session) and 80% of the shares are above their 50D MA (vs 90%).

Singapore's CPI rose 2.0% YoY in August (as expected, vs +1.9% in July) according to the government.

Industrial Goods & Services: Noble Group (NOBL: -2.11% to S$0.93) closed at a 3-month relative low against the Straits Times Index.

Travel & Leisure: City Developments (CIT: -1.15% to S$10.35) closed at a 3-month relative low against the Straits Times Index.

Stock/Benchmark ratio(s) 50D MA cross over: Wilmar International (WIL: +0.94% to S$3.21)

Stock/Benchmark ratio(s) 50D MA cross under: Jardine Cycle & Carriage (JCNC: -4.12% to S$37.49), Jardine Matheson (JM: -3.62% to $55.9).

Stock(s) 50D MA cross under: City Developments (CIT: -1.15% to S$10.35), Jardine Cycle & Carriage (JCNC: -4.12% to S$37.49).

Emerging Stocks Advance on China as Apple Suppliers Rally

By Julia Leite & Maria Levitov - Sep 24, 2013 5:54 AM GMT+0800

Emerging-market stocks rose after a report showed that a gauge of Chinese manufacturing increased to a six-month high. Technology companies climbed, led by Apple Inc. (AAPL)?s suppliers, amid optimism over new iPhone sales.

The MSCI Emerging Markets Index added 0.3 percent to 1,016.30, extending a three-week gain. The Shanghai Composite Index advanced 1.3 percent as GoerTek Inc. (002241), an Apple supplier, surged the most in a month. Brazil?s Ibovespa (IBOV) snapped a two-day slide as Banco Santander Brasil SA led gains in financial stocks after Citigroup Inc. said it?s ?bullish? on the country?s banks. Indonesia?s rupiah paced losses in currencies on speculation local companies are boosting dollar purchases.

Stocks advanced amid optimism that China?s economic growth is picking up, boosting Premier Li Keqiang?s odds of meeting the year?s 7.5 percent expansion goal. The preliminary reading of 51.2 for a Purchasing Managers? Index released today by HSBC Holdings Plc and Markit Economics compared with a 50.9 median estimate from 14 economists surveyed by Bloomberg News.

?The number was very good, much better than expected,? Paul Christopher, the St. Louis-based chief international strategist at Wells Fargo Advisors, said in an interview at Bloomberg?s headquarters in New York. His firm oversees about $1.3 trillion. ?We had been expecting China to do better in the second half, and that?s coming true.?

Technology and consumer discretionary shares led gains among the 10 industries in the MSCI Emerging Markets Index. The measure for developing markets trimmed this year?s decline to 3.7 percent, trading at 10.7 times projected earnings, according to data compiled by Bloomberg. That trails the 14 valuation of the MSCI World Index.

Emerging ETF

The iShares MSCI Emerging Markets Index exchange-traded fund advanced 0.4 percent to $42.23. The Chicago Board Options Exchange Emerging Markets ETF Volatility Index, a measure of options prices on the fund and expectations of price swings, slipped 2 percent to 23.09.

Brazil?s Ibovespa gained as Santander added 2.9 percent. The benchmark gauge will reach 60,000 by the end of the year and to 64,000 in 2014, boosted by the U.S. Federal Reserve?s decision to delay tapering of its bond-buying program and by better-than-forecast economic data in Brazil, Citigroup analysts wrote in a report.

Russian stocks declined for a second day as JPMorgan Chase& Co. reduced the nation?s equities to the equivalent of sell on declining crude prices. OAO Rosneft, Russia?s biggest oil producer, dropped 1.3 percent. JPMorgan upgraded equities in Turkey, Peru and South Africa, saying the Fed?s decision to keep monetary stimulus intact would spur emerging-market stocks for the rest of the year.

?Happy Days?

?The Fed is allowing investors to ?temporarily? relive the happy days of QE-driven EM bonds and equities,? JPMorgan said in the report. ?The switch to bullish EM equities was built on bearish positioning and improving cyclical data in EM.?

Chinese shares climbed the most in two weeks as the bourse resumed trading after a two-day holiday last week. GoerTek jumped 6.2 percent, the most since Aug. 8. Apple sold 9 million iPhones in the weekend debut of two new models, almost double the previous record, and predicted that quarterly revenue would be at the high end of its previously projected range.

The Taiex Index rallied to the highest level since May 29, led by Taiwan Semiconductor Manufacturing Co.

Indian (SENSEX) stocks posted the biggest two-day loss in a month on concern the central bank may take more steps to quell inflation after unexpectedly increased borrowing costs last week. State Bank of India plunged 5.3 percent, sending the S& P BSE Bankex to its biggest retreat in three weeks.

Indonesia?s rupiah fell the most in more than a week amid speculation local companies are boosting dollar purchases to meet month-end debt and import payments.

The premium investors demand to own emerging-market debt over U.S. Treasuries rose two basis points, or 0.02 percentage point, to 317 basis points, according to JPMorgan Chase & Co.

Just to let you know there is a special corner for isolator 's fans n supporters. Pls visit and post there.

So Shiok.....

JUNWEI9756 ( Date: 24-Sep-2013 00:54) Posted:

|

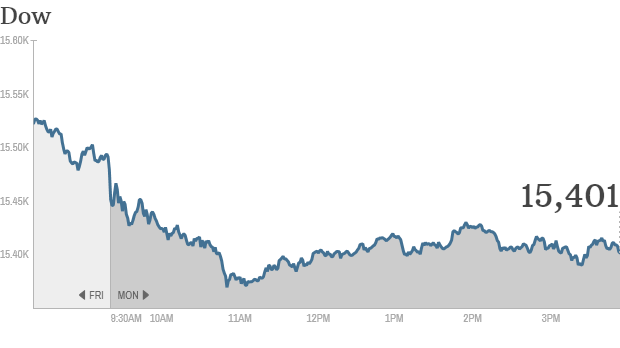

Budget battle weighs on stocks

By CNNMoney Staff @CNNMoneyInvest September 23, 2013: 4:27 PM ETNEW YORK (CNNMoney)

Is the September rally over? Investors were acting cautiously Monday as lawmakers in Washington continue to battle over a budget deal.

The Dow Jones industrial average, S& P 500 and Nasdaq declined modestly.

Unless a compromise is reached during the next week, the government is poised to shut down at the start of October. While investors don't typically worry too much about a shutdown, the political wrangling and gridlock ahead of the budget, as well as the looming debt ceiling deadline may cause some volatility in markets, according to experts.

" We suspect a budget showdown in Washington will likely weigh on global markets for the next several weeks," said Craig Johnson, senior technical research strategist at Piper Jaffray. But he added that any weakness in stocks would be a buying opportunity, as he doesn't believe either Democrats or Republicans would let the country default on its debt.

The budget fight overshadowed positive global economic news, as new data from HSBC showing China's manufacturing sector expanded at the fastest pace in six months.

Related: How a shutdown could affect the economy

The Federal Reserve also remained in focus, following last week's decision to hold off on its plans to taper its bond buying program.

In a speech Monday, New York Fed President William Dudley said he would " like to see news that makes me more confident that we will see continued improvement in the labor market" before cutting back on the central bank's stimulus program.

World Markets

North and South American markets finished mixed as of the most recent closing prices. The Bovespa gained 0.91% and the IPC rose 0.22%. The S& P 500 lost 0.47%.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | -49.71 | -0.32% | 15,401.38 | 4:35pm ET |

|

S& P 500 Index | United States | -8.07 | -0.47% | 1,701.84 | 4:35pm ET |

|

Brazil Bovespa Stock Index | Brazil | +492.35 | +0.91% | 54,602.38 | 6:02pm ET |

|

Canada S& P/TSX 60 | Canada | +0.63 | +0.09% | 735.23 | 4:20pm ET |

|

Santiago Index IPSA | Chile | +111.55 | +3.44% | 3,356.01 | 5:00pm ET |

|

IPC | Mexico | +88.70 | +0.22% | 41,314.68 | 6:06pm ET |

Towkay boss sifu isolator... how are you.... hope everything is good for u...

http://www.cnbc.com/id/101053483

European shares / stocks down, turned lower in a choppy day of trade on Monday, as uncertainty over the formation of a coalition govt in Germany weighed on markets.

teeth53 thot - It touch n go, can go up n oso can come down very fast....see Japan. Most likely pennies will rule n play - speculative n volatile. Afternoon play may oso look to Euro for a leaf n is likely follow DOW style with perhaps German election on focus, it mkt may turn abit +ve. (Markets weighed on Germany).

For general info oni - Major regional index n STI ended mostly in red.