| Octavia ( Date: 09-Oct-2013 09:27) Posted: |

Don't stress out!

Don't worry be happy!

Happy Happy Go Lucky!!!!

Octavia ( Date: 09-Oct-2013 09:36) Posted:

|

A Suddenly Nervous China Tells The US To " Earnestly Take Steps" To Avoid A Default

While the world's largest hedge fund, the Fed, may not care about the performance of its " bad bank" assets, and thus is largely ambivalent if the US Treasury defaults on the $2 trillion in US paper held by Ben Bernanke, others don't have the luxury of merely printing away any incurred MTM losses. Such as America's largest foreign creditor China, which at last check held at least $1.277 trillion in US Treasurys, which after realizing with a substantial delay that the US Congress is not precisely a " rational actor" and its bonds may be materially impaired in the case of a technical default, is starting to panic. In an oped in the largest media publication, China Daily, vice finance minister Zhu Guangyao, warned that the " clock is ticking" to avoid a US default that could hurt China's interests and the global economy. Mr Zhu said that China and the US are " inseparable" . Beijing is a huge investor in US Treasury bonds.Somehow we doubt Boehner or Obama are particularly concerned about what happens to " Chinese interests." Of course, if China so wishes, it can pen an Op-Ed in the NYT and tell the US just what will happen if $1.3 trillion in US Treasurys were suddenly to be dumped in a liquidation fire sale.

Ezion, noble , Indoagri , Kruze ....

Peter_Pan ( Date: 09-Oct-2013 08:49) Posted:

|

The market got some strength.

http://stockmarketmindgames.blogspot.sg/2013/10/sti-short-covering.html

Last few days uncertainty hang over. Volatility will continue but bright spot is just abit more visible.

Due to uncertainty - Obama comfirmed Janet Yellen as new FED chief. as there is not much choice, but for QE to continue for a while more.

Oso due to uncertainty , the next to watch out for will be short term extension of debt ceiling and budget to give both parties time to negotiate.

http://money.cnn.com/2013/10/08/investing/stocks-markets/index.html?iid=HP_LN

Market is still likely volatile...Tech Stocks had another bad day Tuesday as investors became increasingly nervous about a looming debt ceiling crisis.

| 08-Oct-2013 17:22 | |||

Obama ready for negotiation, but not amid threats ....?. Change tactic, din change princple tone.

|

|||

tanglinboy ( Date: 09-Oct-2013 07:18) Posted:

|

GorgeousOng ( Date: 09-Oct-2013 06:34) Posted:

|

Isolator ( Date: 08-Oct-2013 23:52) Posted:

|

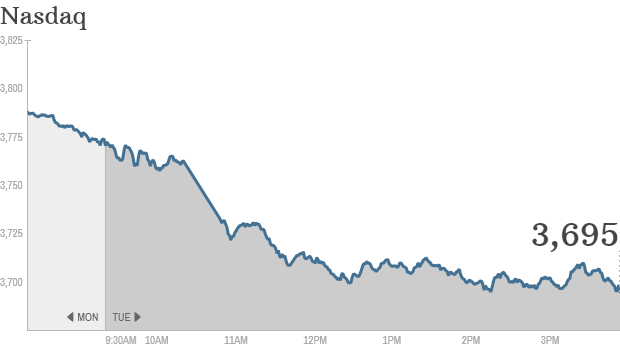

Tech stocks crushed as debt deadline looms

By CNNMoney Staff @CNNMoneyInvest October 8, 2013: 4:36 PM ET

Click chart for more markets data

Stocks had another bad day Tuesday as investors became increasingly nervous about a looming debt ceiling crisis.

The Dow Jones Industrial Average and the S& P 500 both ended the day down more than 1%. But tech stocks were hit particularly hard. The Nasdaq lost 2%.

Only a handful of Nasdaq stocks ended higher for the day. Meanwhile, many momentum stocks that have helped push the Nasdaq up more than 20% dropped sharply Tuesday.

Yahoo (YHOO, Fortune 500), Tesla (TSLA), Priceline (PCLN), Netflix (NFLX), Facebook (FB) and LinkedIn (LNKD) all fell between 3% and 7%.

CNNMoney's Fear & Greed Index now shows that Extreme Fear is driving the market. In another unsettling sign, yields on short-term Treasury bills have skyrocketed in the past few days. That may reflect growing worries from bond investors that the U.S. could actually default on some of its obligations.

Related: Fear & Greed Index plunges into Extreme Fear

Tuesday marked the eighth day of the government's shutdown. While the Dow has dropped more than 300 points in that time, the markets are actually performing better than many had expected. All three major indexes remain up more than 12% for the year.

Despite heated posturing, many experts think the Democrats and Republicans will be able to reach a last-minute agreement to raise the debt ceiling before October 17 and avoid a default.

Political brinksmanship is nothing new for today's markets, said Mark Luschini, chief investment strategist at Janney Montgomery Scott. For example, he noted that despite " a lot of bluster" about the fiscal cliff last year, the stock market ultimately held up well.

European markets finished broadly lower Tuesday, led by a more than 1% decline in London's FTSE 100, while Asian markets ended with gains. The Shanghai Composite index jumped 1% after investors returned from a long holiday

Jia ba buay bao arh !

Peter_Pan ( Date: 09-Oct-2013 06:20) Posted:

|

Oh NO !!

World Markets

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | -159.71 | -1.07% | 14,776.53 | 4:31pm ET |

|

S& P 500 Index | United States | -20.67 | -1.23% | 1,655.45 | 4:31pm ET |

|

Brazil Bovespa Stock Index | Brazil | -104.66 | -0.20% | 52,312.44 | 6:01pm ET |

|

Canada S& P/TSX 60 | Canada | -5.40 | -0.74% | 728.43 | 4:20pm ET |

|

Santiago Index IPSA | Chile | -2.56 | -0.08% | 3,235.03 | 3:15pm ET |

|

IPC | Mexico | -534.32 | -1.32% | 39,916.84 | 6:06pm ET |